nj tax sale certificate premium

Ignoring the law may cost. To accept a New Jersey Resale Certificate the supplier must be registered with the State.

The attorneys at McLaughlin Nardi are well versed in tax sale certificate and tax sale foreclosure law.

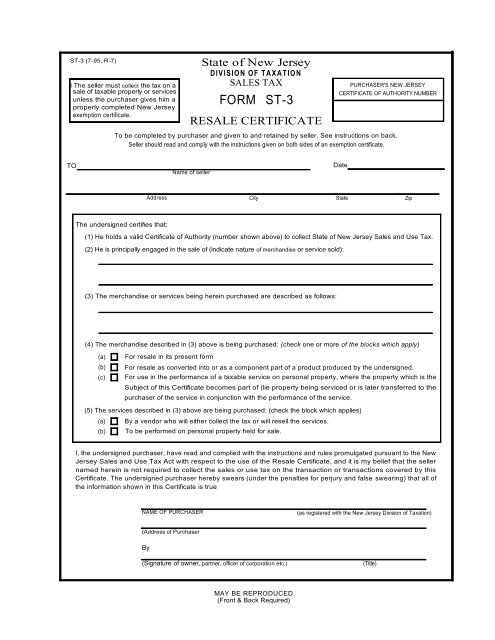

. If a tax sale certificate holder has been paying taxes and earning interest on your property for 9 years the amount that you are going to owe is going to be substantial. Completed New Jersey Resale Certificate Form ST-3 or Streamlined Sales and Use Tax Agreement Certificate of Exemption Form ST-SST. When a municipality has or shall have acquired title to real estate by reason of its having been struck off and sold to the municipality at a sale for delinquent taxes and assessments the governing body thereof may by resolution authorize a private sale of the.

If the tax lien certificate is redeemed by the delinquent property owner prior to foreclosure the tax lien certificate earns a redemption penalty at the rate of 2 4 or 6 percent depending on the amount of the original tax lien certificate in addition to any interest rate on the certificate. Its the only state where the interest rate on the certificate amount is bid down to 0 and then premium is bid. Once the bidders bid down to 0 it will go into a premium starting at multiples of 100.

The seller must collect the tax on a sale of taxable property or services unless the purchaser gives them a fully completed New Jersey exemption certificate. Bond note obligation deemed asset of municipality 545-1134. 545-113 Private sale of certificate of tax sale by municipality.

Acceptance of bond note other obligation as consideration for sale of certificate 545-1132. Bidding stops to obtain the tax sale certificate. 18 or more depending on penalties.

Private sale of certificate of tax sale by municipality. Payments at Sale. The New Jersey Supreme Court in In re.

All municipalities in New Jersey are required by statute to hold annual sales of unpaid real estate taxes. By selling off these tax liens municipalities generate revenue. New Jersey assesses a 6625 Sales Tax on sales of most tangible personal property specified digital products and certain services unless specifically exempt under New Jersey law.

Creation and issuance of Tax Sale Certificates within 10 days day of sale is 1st day. In order to redeem the lien the property owner must pay the certificate amount plus the redemption penalty and the subsequent tax amount at 24. New Jersey is really a different animal.

Interest on subs is 8 per annum until 1500 is owed then its 18. Tax Sale Procedure How does it work Purchasing a tax sale certificate is a form of investment. If you bid premium and most liens in New Jersey are won at high premiums you dont get any interest on the certificate amount however you do get interest on the subsequent tax payments.

Tax sales are conducted by the tax collector. This total doesnt need to include premiums. But if at the sale a person offers a rate of interest less than 1 or at no interest that person may instead of an interest rate offer a premium over the tax amount due including.

Third parties and the municipality bid on the tax sale certificates TSC. Recording of assignments service on tax collector. Quickly Apply Online Now.

The municipality has to give you back your premium of 1000000. New Jersey is a good state for tax lien certificate sales. Recording of assignments service on tax collector.

Tax liens are also referred to as tax sale certificates. Buyers appear at the tax sale and purchase the tax sale certificates by paying the back taxes to the municipality. What is sold is a tax sale certificate a lien on the property.

New Jersey offers grants incentives and rebates to businesses and every recipient must obtain a business assistance tax clearance certificate from the Division of Taxation. NJ Soldiers Sailors Relief Act of 1979. Plymouth Park Tax Services LLC determined that under the Tax Sale Law NJSA.

State of New Jersey Division of Taxation SALES TAX FORM ST-3 RESALE CERTIFICATE Purchasers New Jersey Taxpayer Registration Number To be completed by purchaser and given to and retained. If you invest in tax sale certificates be mindful of the complexities of the governing state law when you file a bankruptcy proof of claim on account of the certificate. Skip the Lines Apply Online Today.

At the conclusion of the sale the highest bidder pays the outstanding. New Jersey Tax Lien Auctions. Bids that reach 0 then go to premium bids.

Delinquency on a property may accrue interest at up to 8 for the first 150000 due and 18 for any amount over 150000 If the delinquency exceeds 1000000 at the end of a municipalities fiscal year there may be an addition 6 penalty. The lien holder pays the debt owed to the municipality by the assessed owner of the property and in return is guaranteed the interest rate on the amount paid when the lien is redeemed. Since the price of the properties is already fixed simply mark the properties you plan to bid on and deposit 10 percent of the total.

Fast Easy and Secure Online Filing. According to New Jersey Law on tax lien certificate greater than 200 a penalty of 2 is. If you are served with a foreclosure complaint or wish to pursue a claim on a tax sale certificate please call us at 973 890-0004 or e-mail us to see how we can assist you.

Ad Get Your Sellers Permit for Only 6995. If a bid made at the tax sale meets the legal requirements of the Tax Sale Law the municipality must either sell the lien or outbid the bidder. The premium is returned to the investor should the lien redeem but no interest is paid on the premium amount.

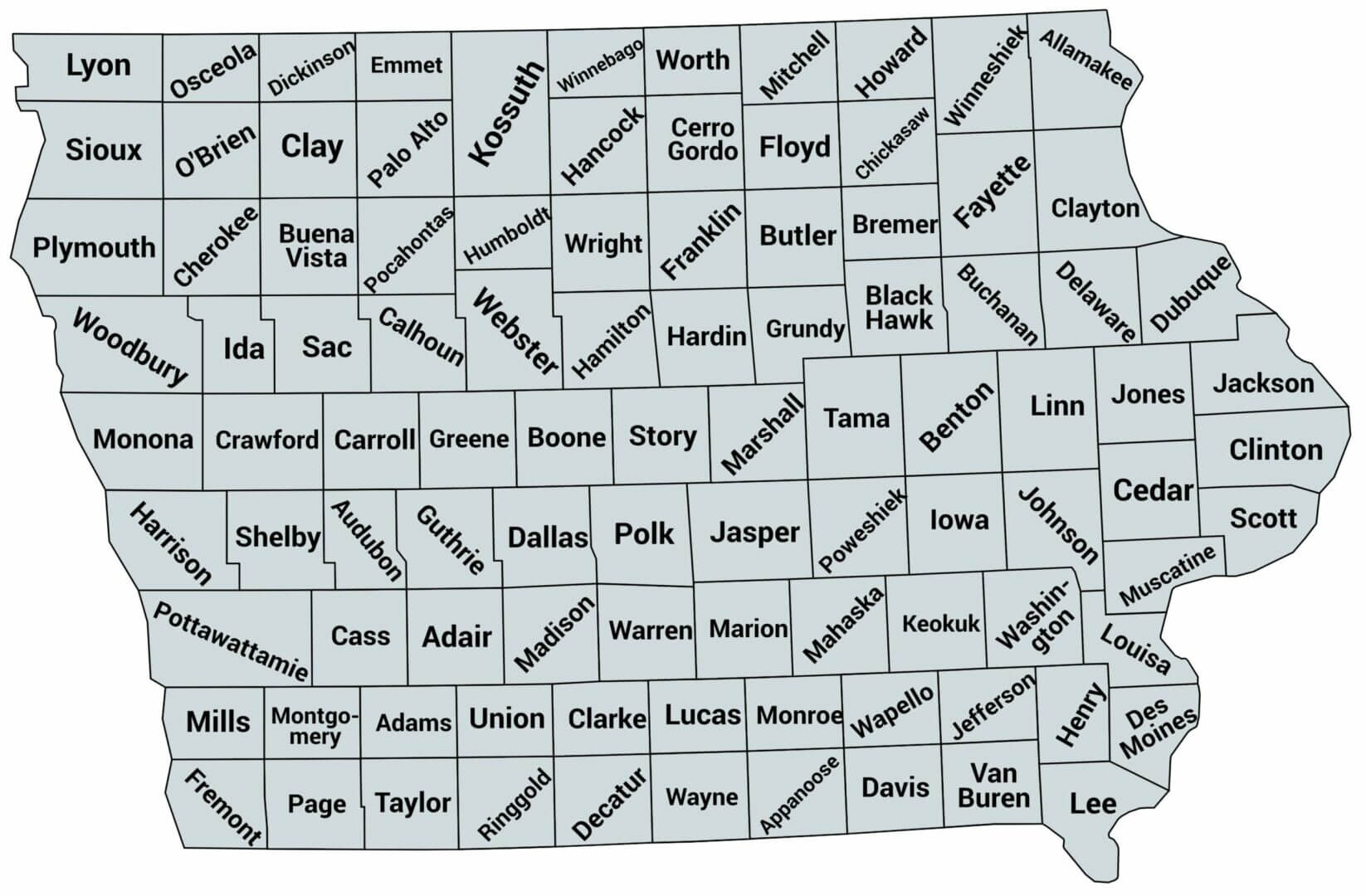

Dates of sales vary depending on the municipality. Again in a New Jersey tax sale the property is sold at a public auction subject to the right of redemption to the person who offers the lowest interest rate on the tax debt which cant exceed 18. Elements of Tax Sales in New Jersey.

Tax sale certificates can earn interest of up to 18 per cent depending on the winning percentage bid at the. Sales and Use Tax Forms. 545-1 to -137 a purchaser of a tax sale certificate acquires a tax lien not a lien securing the property owners obligation to pay the amount owing to redeem the certificate.

The purchaser must complete all fields on the exemption certificate in order to claim the exemption. After July 1 2017 any applicant for certification that cant obtain a Premier Business Services account may submit a paper application Gtb-10 for business. Videos you watch may be added to the TVs watch history and influence TV.

Here is a summary of information for tax sales in New Jersey. A day or two before the sale at the latest you must submit a deposit of at least 10 percent of the amount you plan to bid at the tax sale. There is no requirement that the tax sale certificate holder begin a foreclosure after the expiration of the 24 month period from initial purchase.

Thats 5000 lien amount 200 4 redemption penalty 1000000 subsequent taxes 240000 24 of subs 17600. The premium is kept on deposit with the municipality for up to five. If playback doesnt begin shortly try restarting your device.

Real Estate and Tax Law. You will find that very high premiums are paid for NJ tax liens. Sales Tax Collection Schedule 6875 effective 01012017 through 12312017.

Sales and Use Tax. Removal of lessee tenant 545-1133. Princeton Office Park LP.

Tax Sale Lists Now Home Facebook

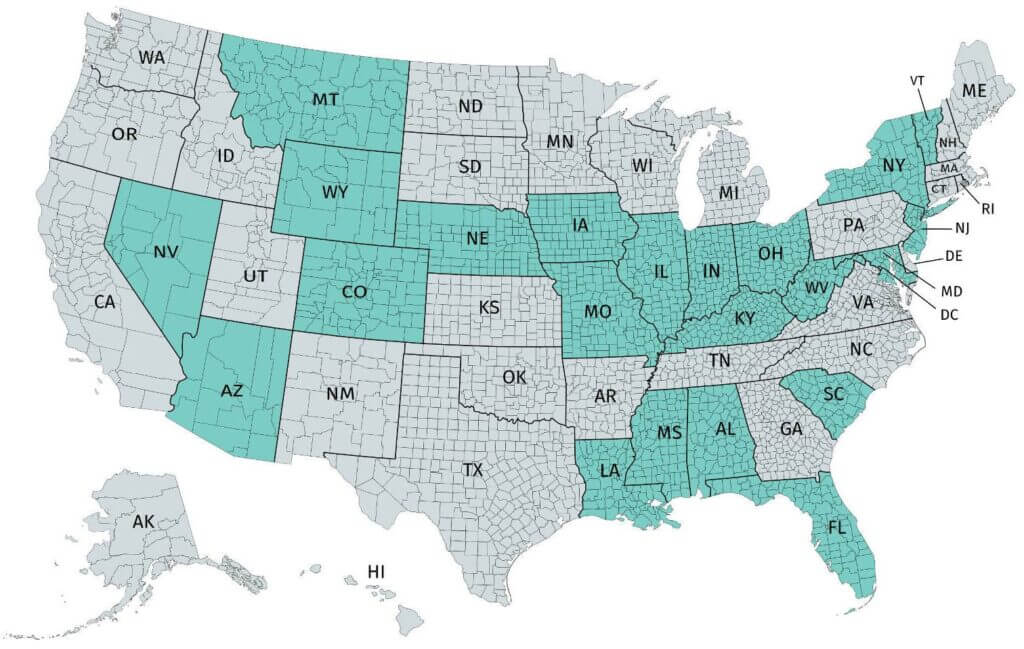

The Essential List Of Tax Lien Certificate States Tax Lien Certificates And Tax Deed Authority Ted Thomas

New Jersey Tax Sale Certificate Foreclosure Pscb Law New York And New Jersey Lawyers New Jersey Foreclosure Defense

Realtaxlien Online Delinquent Tax Lien Certificate Software

The Essential List Of Tax Lien Certificate States Tax Lien Certificates And Tax Deed Authority Ted Thomas

Tax Sale Lists Now Home Facebook

Bidding At The Tax Sale The Good The Bad And The Ugly

What Is A Tax Sale Ontario Tax Sales

How To Buy Bank Owned Property 6 Great Tips Buying Investment Property Real Estate Investor Foreclosed Properties

Indian Hotel Bill Format In Word 9 Bahamas Schools Invoice Template Invoice Sample Invoicing Software

New Jersey Tax Sales Explained Tax Liens Tax Deeds A Goldmine For Real Estate Investors Youtube